§ 30 Capital maintenance

(1) Those assets which the company requires to maintain its share capital may not be paid out to the shareholders. Sentence 1 does not apply to payments made upon the existence of a control or profit transfer agreement (section 291 of the Stock Corporation Act) or to payments which are covered by a full claim to counterperformance or restitution against a shareholder. Sentence 1 also does not apply to the repayment of a shareholder loan and payments against claims arising from legal acts which correspond economically to a shareholder loan.

(2) If they are not needed to cover a loss in share capital, any paid in additional contributions may be repaid to the shareholders. The repayment may not be made before three months have elapsed since the decision to make the repayment was made known in accordance with section 12. In the case referred to in section 28 (2), repayment of additional contributions is inadmissible before the share capital has been deposited in full. Repaid additional contributions are deemed not to have been collected.

Information for non-professionals

To Information for legal professionals

Relevance for legal relations

a) Legal Relations

1Section 30 German Limited Liability Companies Act (Gesetz betreffend die Gesellschaften mit beschränkter Haftung – GmbHG) is one of the central provisions in the regulatory structure for raising and maintaining capital in a Limited Liability Company (GmbH). The Federal Court of Justice (BGH) describes Sections 30 GmbHG and Section 19 GmbHG as the “core of the law on limited liability companies”.Federal Court of Justice, Judgement of 30.06.1958 – II ZR 213/56, BGHZ 28, 77

2Section 30 I GmbHG contains - in short - a prohibition on payments by the GmbH to its shareholders if the payment would be at the expense of the GmbH's share capital (subscribed capital). Section 30 II GmbHG supplements the protection of the (equity) capital of the GmbH by restricting the free repayment of additional contributions (besides the contribution of the share capital) within the meaning of Sections 26 et seq. GmbHG, which are, however, not very common in practice.

3Section 30 GmbHG primarily serves to protect the creditors of the company. As the shareholders of a Limited Liability Company such as a GmbH are generally only obliged to make a payment on the shares they have subscribed to, but are not personally liable for the liabilities of the GmbH, the regulations on raising capital (in particular Sections 14, 19 GmbHG) and capital maintenance (Sections 30, 31 GmbHG) are intended to ensure that, at minimum, the share capital of the GmbH is maintained and is available for the settlement of claims of the company's creditors. Section 30 I sentence 1 GmbHG therefore stipulates a payment prohibition that prohibits payments by the GmbH to its shareholders if this payment would affect the share capital (subscribed capital).

4The protected share capital, which is referred to as “subscribed capital” in the balance sheet, corresponds to the amount of share capital stated in the articles of association and registered in the commercial register, irrespective of whether the contributions on the subscribed shares have already been paid in full.

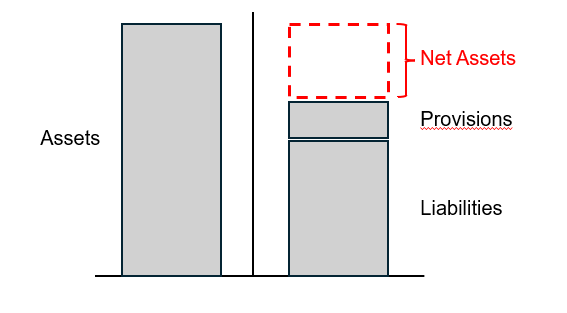

Whether the share capital is affected by the payment to the shareholder must be examined on the basis of an interim balance sheet as at the time of the payment, which must be prepared in accordance with the principles of commercial law. This interim balance sheet is used to determine the so-called “Net Assets” (Reinvermögen) of the GmbH, which is the difference between the assets and the “real” liabilities, i.e. provisions and liabilities:

5If the Net Assets determined as described before are lower than the share capital (subscribed capital) this is referred to as an short balance (Unterbilanz). If a short balance is already apparent at the time of the intended payment to the shareholder or if the Net Assets would fall below the share capital as a result of such payment, payment is prohibited in accordance with Section 30 GmbHG.

6It is important to note that the term “payment” does not only include direct cash payments by the GmbH to its shareholder, but is defined extensively for the protection of creditors. A prohibited payment within the meaning of Section 30 I sentence 1 GmbHG can therefore be benefits of any kind for the favor of a shareholder that lead to a reduction in the company's assets, such as the transfer of property or rights or the waiver of claims. The assumption of liabilities or the creation of new liabilities to third parties can also be a “prohibited payment” within the meaning of Section 30 GmbHG, provided that this is done at the request or in the interest of the shareholder (e.g. assumption of liabilities of the shareholder without compensation or creation of obligations towards third parties who provide their services to the shareholder for private use).

7On the other hand, the shareholder is of course not prohibited from having business relationships with “his” GmbH, for example if the shareholder of the GmbH leases business property, sells goods to or simply provides services for the GmbH, e.g. as managing director or consultant.

8The question of whether a benefit provided by the GmbH to its shareholder results in a reduction in assets at the expense of the share capital must always be considered from a balancing perspective. If the payment made by the GmbH to its shareholder is offset by an equivalent consideration, there is no reduction in assets from a balancing perspective that could affect the share capital. For example, if the GmbH acquires goods at market value from its shareholder, the (purchase price) payment to the shareholder is offset by the acquired asset, which compensates for the cash outflow in the balance sheet.

9In order to determine whether a permissible transaction or a prohibited payment was made in an individual case, it is determined whether a prudent managing director acting in accordance with commercial principles would also have concluded the transaction with a non-shareholder under the same circumstances and on the same conditions, i.e. whether the payment was justified by business reasonsFederal Court of Justice, Judgement of 13.11.1995 – II ZR 113/94, ZIP 1996, 68 (so-called “arm's length principle”). If the transaction between the shareholder and the GmbH does not comply with the arm's length principle, for example because the shareholder sells goods to the GmbH at inflated prices or, conversely, purchases goods from the GmbH below market value, there is a hidden distribution to the shareholder in the amount of the difference, which leads to a breach of the payment prohibition of Section 30 I sentence 1 GmbHG if a short balance has already applied (see above). A “classic” in this context is excessive management remuneration for the shareholder-managing director or excessive fees as part of a consultancy agreement between the shareholder and the GmbH.

10If the GmbH makes payments to its shareholder in breach of the payment prohibition in Section 30 I sentence 1 GmbHG, the shareholder concerned is obliged to reimburse the payment received in breach of the prohibition in accordance with Section 31 I GmbHG. If the shareholder concerned is unable to make the reimbursement, the other shareholders are liable for the reimbursement on a pro rata basis in accordance with Section 31 III GmbHG. Although the subsidiary liability of co-shareholders pursuant to Section 31 III GmbHG only applies if the amount to be reimbursed is “necessary to satisfy the company's creditors”, this requirement is generally met, as claims for reimbursement pursuant to Sections 30, 31 GmbHG are usually asserted by the insolvency administrator in the GmbH's insolvency proceedings.

11For reasons of creditor protection and to prevent attempts of circumvention, the capital maintenance regulations also apply to third parties in various constellations defined by case law, i.e. the payment prohibition of Section 30 I sentence 1 GmbHG can also apply if the GmbH does not make a payment directly to the shareholder, but to a third party, if this third party is legally or familiarly related to the shareholder or the payment was initiated by the shareholder. Please refer to the expert section below for explanations of the individual cases.

12Conversely, Section 30 I sentences 2 and 3 GmbHG also provide for exceptions to the prohibition of payment:

- According to Section 30 I sentence 2, 1st alternative GmbHG, the payment prohibition does not apply if a control and profit transfer agreement (Beherrschungs- und Gewinnabführungsvertrag) within the meaning of Section 291 I German Stock Corporation Act (Aktiengesetz – AktG) exists between the shareholder (controlling company) and the GmbH (controlled company). This is because the controlling company (shareholder) is then obliged under Section 302 I AktG to compensate for losses of the controlled GmbH, which in the opinion of the legislator guarantees a level of protection in favor of creditors equivalent to the capital maintenance regime.

- According to Section 30 I sentence 2, 2nd alternative GmbHG, the prohibition of payment also does not apply if the GmbH's payment is offset by an equivalent claim for consideration or restitution against the shareholder. If, for example, the GmbH pays a purchase price to the shareholder, but in return receives a claim to the acquisition of an equivalent item, or grants the shareholder a loan which the shareholder is able to repay at any time due to his creditworthiness, the payment of the purchase price or the granting of the loan does not constitute a prohibited payment within the meaning of Section 30 I sentence 1 GmbHG. The provision is purely declaratory, because according to the relevant balancing approach (see above), there is no reduction in assets for the GmbH if it acquires an equivalent claim to consideration for its payment to the shareholder. The legislator introduced the provision primarily to prevent legal uncertainties in connection with cash pooling, which is particularly common between group companies. This is because in the context of cash pooling, liquidity transfers from subsidiaries to the parent company managing the cash pool are generally treated as loans from a legal perspective and the provision in Section 30 I sentence 2, 2nd alternative GmbHG shall clarify that such liquidity transfers are permissible from the perspective of Section 30 I sentence 1 GmbHG, provided that the parent company managing the cash pool is financially able to meet the claims of the subsidiaries from the cash pooling.

- Finally, according to Section 30 I sentence 3 GmbHG, repayments made by the GmbH to repay shareholder loans are excluded from the payment prohibition. This is because the law on shareholder loans was completely transferred to the German Insolvency Code (Insolvenzordnung – InsO) by the Act to Modernize the Law on Limited Liability Companies and Combat Abuses (MoMiG).Federal Law Gazette, BGBl. I 2008, S. 2026, Bundesgesetzblatt BGBl. Online-Archiv 1949 - 2022 | Bundesanzeiger Verlag The new insolvency law provisions now stipulate the general subordination of shareholder loans (Section 39 I No. 5 InsO) on the one hand, and on the other hand, loan repayments made by the GmbH to its shareholder in the last year before the application for insolvency are generally subject to insolvency contestation in accordance with Section 135 I No. 2 InsO.

For further explanations on the exceptions described above, please refer to the expert section below.

b) Impact for Shareholders

13For the shareholder as the recipient of the payment, the prohibition of payment in Section 30 I sentence 1 GmbHG primarily implies that he must reimburse payments that he has received from the company in breach of Section 30 I sentence 1 GmbHG in accordance with Section 31 I GmbHG, irrespective of whether the share capital has been refilled in the meantime in another way, for example through profits that have accrued again. The claim for reimbursement is also only time-barred after 10 years (Section 31 V sentence 1 GmbHG) and can be asserted by the insolvency administrator in insolvency proceedings.

14However, breaches of Section 30 I sentence 1 GmbHG also entail liability risks for the co-shareholders of the recipient of the payment. This is because if the prohibited payment cannot be obtained from the recipient of the payment, the other shareholders are liable on a pro rata basis in proportion to their shares (Section 31 III sentence 1 GmbHG). Although the subsidiary liability of co-shareholders pursuant to Section 31 III GmbHG only applies if the amount to be reimbursed is “necessary to satisfy the company's creditors”, this requirement is generally met, as claims for reimbursement pursuant to Sections 30, 31 GmbHG are usually asserted by the insolvency administrator in the GmbH's insolvency proceedings.

c) Impact for Managing Directors

15In addition to the co-shareholders of the recipient of the payment, it is primarily the managing director who bears the liability risks in the event of breaches of Section 30 I sentence 1 GmbHG.

If the co-shareholders of the recipient are required to reimburse the prohibited payment due to the default of the actual recipient of the payment in accordance with Section 31 III GmbHG, they can take recourse against the managing director in accordance with Section 31 VI GmbHG if the managing director intentionally or negligently violated the payment prohibition when effecting the payment.

16Furthermore, in the event of prohibited payments, the company itself is also entitled to a claim for damages against the managing director in accordance with Section 43 III sentence 1 GmbHG, which is typically asserted by the insolvency administrator in insolvency proceedings. Unlike claims for damages under Section 43 II GmbHG, claims for damages under Section 43 III sentence 1 GmbHG cannot be extinguished in advance by discharge, settlement or waiver and the managing director is also not exculpated by the fact that he has complied with a resolution of the shareholders if the amount of damages is “necessary to satisfy the creditors”, which is regularly the case in insolvency proceedings.

17In addition, the managing director is liable under Section 15b V sentence 1 InsO for payments to shareholders that lead to the insolvency of the GmbH. This claim is also regularly asserted by an insolvency administrator after insolvency proceedings have been opened.

d) Impact for Creditors

18As compensation for the limitation of liability, the capital maintenance system primarily serves the purpose of protecting the assets of the GmbH against interventions by the shareholders and ensuring that sufficient assets are retained for the satisfaction of company's creditors. Nevertheless, this objective can only be achieved to a limited extent (cf. the criticism of the current capital maintenance system in the literature set out below).

19As the claim for reimbursement pursuant to Section 31 I GmbHG is a claim of the GmbH against its shareholder, company creditors who have obtained an enforcement order against the GmbH for a claim can seize the claim and have it transferred to them for collection (Sections 829, 835 German Code of Civil Procedure, Zivilprozessordnung – ZPO) in order to then take direct action against the shareholder who received the prohibited payment. However, it is generally almost impossible for an outside creditor who does not have access to the GmbH's books and business transactions to provide evidence.

20From a tax perspective, a prohibited payment within the meaning of Section 30 I sentence 1 GmbHG can also constitute a hidden profit distribution (verdeckte Gewinnausschüttung - vGA).

According to the established jurisdition of the Federal Fiscal Court (BFH), a hidden profit distribution is deemed to exist if the company grants its shareholder a benefit outside of the distribution of profits under company law and this benefit has its origin in the company relationship. An origin in the company relationship is given if a prudent and diligent managing director would not have granted this benefit to a non-shareholder.Federal Fiscal Court, Resolution of 05.09.2023 – VIII R 2/20, DStZ 2024, 6, Entscheidung Detail | Bundesfinanzhof Also in this context, it is therefore generally a matter of transactions between the GmbH and its shareholder that do not comply with the arm's length principle (see above) - often in connection with excessive remuneration of the shareholder-managing director.

Information for legal professionals

1) General

a) Background / Regulatory Purpose

21Unless an obligation to make additional contributions (Section 26 et seq. Limited Liability Companies Act, Gesetz betreffend die Gesellschaften mit beschränkter Haftung – GmbHG) is incorporated in the articles of association, which is not very common in practice, the shareholders are generally only obliged to make their contribution

2) Definitions

a) Share Capital (Subscribed Capital)

aa) Explanatory notes

113The relevant share capital amount that must be covered in order for a payout to be permitted in accordance with Section 30 GmbHG is the share capital amount stated in the articles of association and entered in the commercial register, irrespective of whether the contributions have already been paid in full or the company has acquired its own shares in the meantime (Section 33 GmbHG).

3) Differentiation, casuistics

a) Loan relationships between GmbH and shareholder

127Loan transactions between the company and the shareholder are quite simple to categorize: The repayment of a loan granted to the GmbH by the shareholder does not constitute a prohibited disbursement (Section 30 I sentence 3 GmbHG), as such actions may be subject to contestation in insolvency (Section 135 InsO).

4) Summary of the jurisdiction

147With regard to the relevant jurisdiction, first of all reference is made to the rulings listed under “Definitions” for the respective element of the statute.

In addition, decisions on the following interesting constellations can be mentioned:

a) Invalidity of the resolution to exclude a shareholder

148Federal Court of Justice, Judgement of 11.07.

5) Literature

155In the literature, the system of capital maintenance in its current form is criticized in various ways as ineffective and inadequate with regard to creditor protection.

156Not even the legally prescribed minimum capital of “only” EUR 25,000, depending on the size and business volume of the company, does necessarily guarantee an equity base that is adequate for business operations.

6) Frequently used (chains of) clauses

21Section 30 and section 31 of the German Limited Liability Companies Act (GmbHG): Section 30 GmbHG, which contains the prohibition, is directly related to Section 31 GmbHG, which regulates the reimbursement claim in the event of payments that violate the prohibition.

22Also to be seen in the context of capital maintenance (

7) Procedural details

167The claimant of the reimbursement claim pursuant to Section 31 I GmbHG is generally the company, i.e. creditors of the GmbH can seize the claim and have it transferred to them for collection (Sections 829, 835 German Code of Civil Procdure, Zivilprozessordnung - ZPO). In insolvency proceedings over the assets of the GmbH, the insolvency administrator asserts the reimbursement claim against the recipient of the payment in accordance with Section 31 I GmbHG.

168In addition, there may be competing claims for damages, e.g. due to existence-destroying interventions (Section 826 German Civil Code, Bürgerliches Gesetzbuch - BGB), which may exceed the claim for reimbursement under Section 31 GmbHG. Claims arising from insolvency contestation (Sections 129 et seq. German Insolvency Code, Insolvenzordnung - InsO), in particular due to gratuitous payments (Section 134 InsO) or repayment of a shareholder loan (Section 135 InsO) are also not excluded by Section 31 GmbHGScholz/Verse, Commentary on Limited Liability Companies Act (GmbHG), Volume I (§§ 1-34), 13th edition (2022),

169The burden of proof for a payment in breach of Section 30 I sentence 1 GmbHG is generally borne by the claimant, i.e. the GmbH or, in insolvency proceedings, the insolvency administrator

170According to the jurisdiction of the Higher Regional Courts, however, in the category of unbalanced transactions, i.e. if the GmbH grants the shareholder a loan on unusual terms, grants the shareholder excessive remuneration or sells assets below market value, the burden of proof shall be on the opposing party, i.e. the shareholder, to demonstrate and prove that the company's performance is offset by an equivalent consideration from the shareholder, i.e. that the transaction took place on balanced terms hat.Higher Regional Court of Düsseldorf, Judgement of 21.10.2016 – I-16 U 178/15, GmbHR 2017, 239; Higher Regional Court of Hamm, Judgement of 13.03.2017 – I-8 U 79/16, GmbHR 2017, 703; Noack/Servatius/Haas/Servatius, Commentary on Limited Liabilities Companies Act (GmbHG), 23rd edition (2022),

171The burden of proof for the existence of an exception pursuant to Section 30 I sentence 2 or sentence 3 GmbHG, on the other hand, lies with the shareholder as the opposing party.Verse (cf. footnote 1),

172Section 31 I GmbHG generally only results in the reversal of the transaction of disposal, i.e. the unlawful payment within the meaning of Section 30 I sentence 1 GmbHG, but does not affect the contractual or statutory obligation. If the shareholder is therefore entitled to a claim against the company on the basis of an effective contractual or statutory regulation, the fulfillment of which would violate Section 30 I sentence 1 GmbHG, the managing director must refuse performance and, due to his duty to monitor, ensure that the prohibited payment is also not made by co-directors or employees of the GmbH.Federal Court of Justice, Judgement of 25.06.2001 – II ZR 38/99, BGHZ 148, 167, Urteil des II. Zivilsenats vom 25.6.2001 - II ZR 38/99 - (bundesgerichtshof.de)

173If the shareholder brings an action for performance against the GmbH, the payment prohibition pursuant to Section 30 I GmbHG constitutes an objection to be considered ex officio in the proceedings,Federal Court of Justice, Judgement of 15.02.1996 – IX ZR 245/94, ZIP 1996, 538; Verse (cf. footnote 1),