§ 1 Purpose; number of founders

Limited liability companies may be formed by one person or several persons in accordance with the provisions of this Act for any purpose permitted by law.

Information for non-professionals

To Information for legal professionals

Relevance for legal relations

a) General information

1A limited liability company (GmbH) is (irrespective of its statutory purpose) a commercial company with a corporate organization and its own legal personality. It has a share capital determined in its articles of association (§§ 5, 5a GmbHG), which corresponds to the sum of the contributions to be paid by the shareholders on the shares.

The shareholders are not liable for liabilities created by the GmbH and are exclusively obligNoack/Servatius/Haas/Fastrich, GmbHG, 23. Ed. (2022), Intr. Rn. 1

ed to raise the share capital (§

A subform of the GmbH is the Unternehmergesellschaft (haftungsbeschränkt), or UG for short (

b) Legally permissible purpose

2

c) Shareholders

3According to the wording of

4d) On insolvency law: The GmbH in the restructuring

Table of contents

(1) Introduction

(a) The term "crisis" and phases of a crisis

(b) Reasons for filing for insolvency

(aa) Insolvency, Sec. 17 InsO

(bb) Imminent insolvency, Sec. 18 InsO

(cc) Overindebtedness , Sec. 19 InsO

(c) Legal aspects of the crisis

(aa) Crisis prevention

(bb) Early crisis detection through risk controlling

(cc) Crisis management

(aaa) Duty of the managing directors to restructure, Sec. 1 I 2 StaRUG

(bbb) Convening of the shareholders' meeting , Sec. 49 III GmbHG

(ccc) Tension between out-of-court restructuring and filing for insolvency in the event of imminent insolvency

(ddd) Obligation to file for insolvency pursuant to Sec. 15a InsO

(eee) Liability

(dd) Criminal law aspects of the crisis

(2) Restructuring outside a structured procedure

(a) General / Restructuring concept

(b) Restructuring measures

(aa) Financial restructuring measures

(bb) Company sale

(cc) Liquidation

(3) StaRUG proceedings

(a) General

(b) Restructuring plan and judicial restructuring framework

(c) Restructuring moderation, Sec. 94 to 100 StaRUG

(d) Practical example: Restructuring of a holding company

(4) Debtor-in-possession-management, Sec. 270 ff. InsO

(a) General, Aim of debtor-in-possession-management

(b) Preliminary debtor-in-possession-management

(c) Debtor-in-possession-management in opened proceedings

(aa) Requirements for the order of debtor-in-possession-management

(bb) Legal status of the insolvency monitor

(cc) Repeal

(5) Protective Shield Proceedings

(a) Norm Purpose

(b) Practical example: Restructuring of a sales company of a globally operating wine wholesale company

(6) Regular procedure (third-party management)

(a) General

(b) Insolvency opening proceedings

(aa) Insolvency filing

(bb) Provisional insolvency administration

(aaa) Preliminary insolvency administrator

(bbb) Strong preliminary insolvency administrator

(dd) Other provisional measures

(ee) Insolvency allowance

(c) The person of the insolvency administrator

(d) Effects of the opening of proceedings

(aa) General effects

(bb) Existing legal transactions

(cc) Insolvency avoidance

(dd) Administration and liquidation of the insolvency estate

(e) Costs of the insolvency proceedings

(f) Insolvency plan

(aa) General

(bb) Submission authorization

(cc) Components of the insolvency plan

(dd) Voting procedure

(ee) Confirmation of the insolvency plan

(ff) Legal effects of the insolvency plan

(gg) Tax treatment of reorganization profits in insolvency plan proceedings

(g) Practical example of an asset deal: Transferring the reorganization of a specialty mechanical engineering company

(h) Practical example of an insolvency plan: Restructuring of a spa company

(1) Introduction

(a) The term "crisis" and phases of a crisis

5The business crisis begins well before the entry into material insolvency and finally reaches its climax with the existence of a reason for insolvency (impending insolvency/overindebtedness).BGH, Beschl. v. 29.10.2020 – 5 StR 618/19 = NStZ 2021, 308

Business crisis

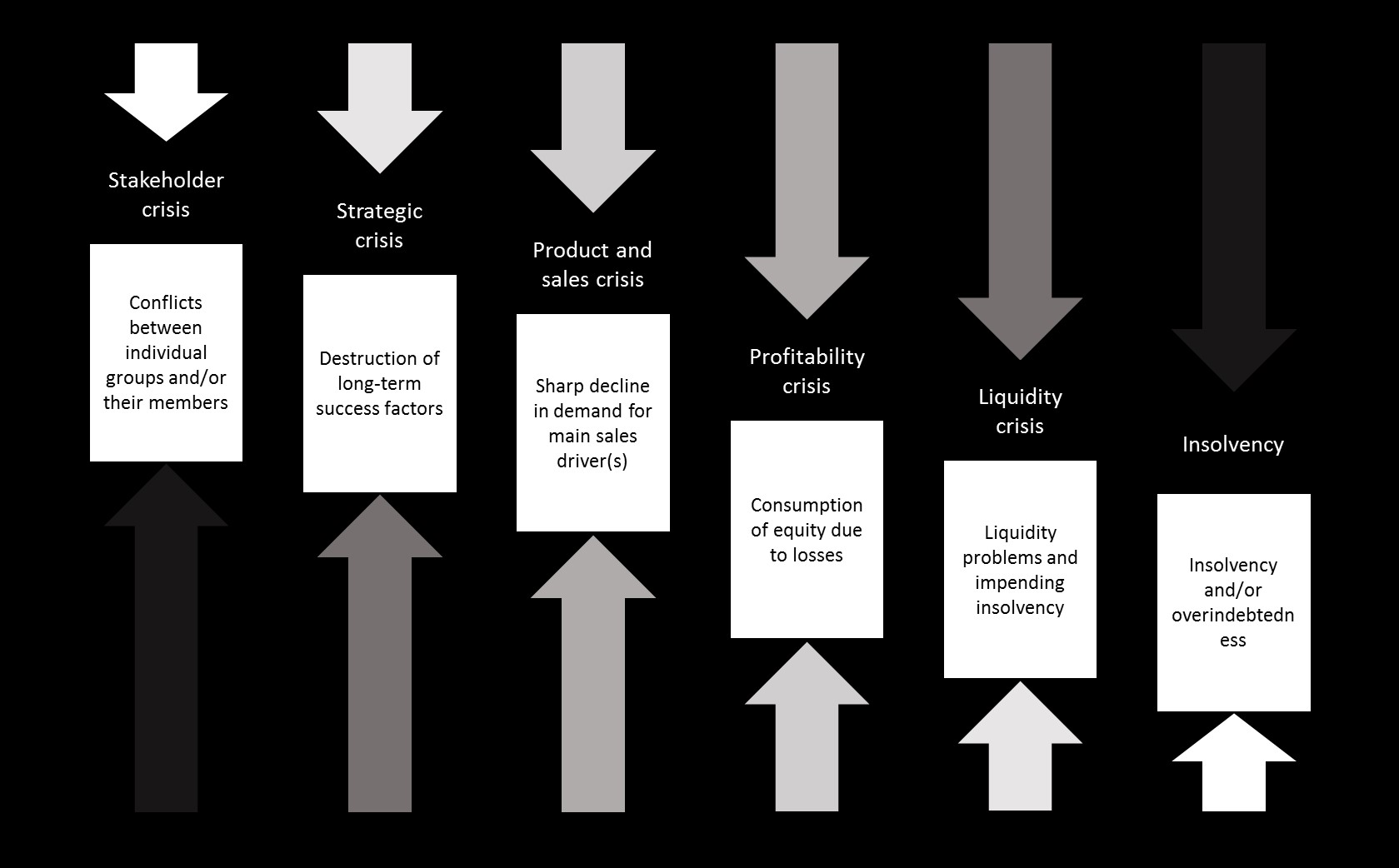

6Prior to the onset of material insolvency, various phases can be distinguished in the course of a business crisis. These can be distinguished from one another on the basis of typical symptoms, whereby the individual crisis stages classically, but not necessarily, occur in succession, but can also overlap in the course of the crisis (see below).BGH, Beschl. v. 29.10.2020 – 5 StR 618/19 = NStZ 2021, 308

Figure 1: Adapted from: Schmidt/Uhlenbruck/Sinz, GmbH in Krise, Sanierung und Insolvenz, 5th ed. (2016), Sidenr. 1.2

7The stakeholder crisis is the earliest stage of the crisis and is characterized by dwindling trust and a declining willingness to cooperate among stakeholders and in relation to the company.Compare Bea/Dressler, NZI 2021, 67 Typical signs of this phase are a decreasing willingness to perform on the part of the employees as well as increasing carelessness. Controlling results are ignored and cohesion within the company dwindles. As a result, the trust of external stakeholders (e.g. customers or suppliers) also dwindles. The lack of cohesion between internal and external stakeholders results in undesirable developments not being recognized and communicated, so that these developments are driven even further.Compare Schmidt/Uhlenbruck/Sinz, GmbH in Krise, Sanierung und Insolvenz, 5. Ed. (2016), Sidenr. 1.4

8In the strategy crisis, a divergence increasingly develops between the targeted and actual position in the competitive environment. The strategic orientation of the company is not (or no longer) suitable for achieving the desired position in the competitive environment or for securing it in the long term.

9Examples of such a strategic crisis include Blackberry and Nokia. Both manufacturers failed to recognize the potential of the "smartphone" in time and therefore lost their exposed competitive positions.

10If a strategy crisis is not recognized, the strategic misalignment initially results in a stagnation of demand for previously successful products, but in the long term in a decline in demand for these main sales drivers. If this trend continues and becomes entrenched, it eventually leads to declining sales figures.Schmidt/Uhlenbruck/Sinz, GmbH in Krise, Sanierung und Insolvenz, 5. Ed. (2016), Sidenr. 1.6.; Thierhoff/Müller/Beck/Stannek, Unternehmenssanierung, 3. Ed. (2022), Chapt. 12 Sidenr. 78 Typically, inventory builds up during this phase, mostly due to attempts to compensate for declining production capacity utilization. In addition, marketing measures usually no longer have an impact and the sales channels also do not function as desired, so that there is often a reduction in sales figures and ultimately also the first effects on the financing structure.Thierhoff/Müller/Beck/Stannek, Unternehmenssanierung, 3. Ed. (2022), Chapt. 12 Sidenr. 78

11If the decline in sales continues, profits will soon no longer be generated. This is followed by losses and a depletion of equity.Schmidt/Uhlenbruck/Sinz, GmbH in Krise, Sanierung und Insolvenz, 5. Ed. (2016), Sidenr. 1.7 The deteriorated operating performance is now visible in the balance sheet. There is a threat of balance sheet over-indebtedness. The deterioration in the balance sheet ratios also reduces the creditworthiness of the company.See Footnote 6

12Due to the lack of capital resources, liquidity bottlenecks occur, additional loans have to be taken out and, if necessary, loans are cancelled, or credit lines are shortened. Reminders from creditors accumulate, arrears with the tax office and social security agencies arise. If the liquidity crisis cannot be overcome, it ultimately leads to insolvency.

(b) Reasons for filing for insolvency

13The occurrence of material insolvency represents the climax of the corporate crisis. The threat of insolvency, which is regulated in Sec. 18 InsO and precedes insolvency, plays a special role in this context, as it entitles the managing director to file an insolvency petition in accordance with Sec. 18 I InsO, but does not oblige him to do so. Therefore, there is no talk of the GmbH being insolvent until insolvency or overindebtedness has occurred. In fact, the insolvency reason of over-indebtedness plays a minor role. In order to respond appropriately to the current ongoing energy crisis, the German parliament, based on a draft bill of the federal government,Compare Änderungsantrag der BR zu BR-Dr. 20/2730 has decided to make adjustments to the forecast period for determining over-indebtedness, the maximum period for filing an application due to over-indebtedness and the planning period for self-administration and restructuring plans.BT-Dr. 20/4087 The corresponding changes are discussed at the relevant places.

(aa) Insolvency, Sec. 17 InsO

14According to Sec. 17 II 1 InsO, a GmbH is insolvent if it is unable to meet its payment obligations as they fall due. In order to determine the insolvency, it is determined on a reference date what free cash is immediately available to meet the payment obligations due. If all liabilities due on the reporting date can be covered, the debtor company continues to be solvent. In the event of an existing shortfall in cover, in order to exclude only temporary payment stagnations from the definition of insolvency, it is determined in a second step whether the liquidity gap that has arisen can be closed again within a short period of time. The Federal Court of Justice has established that a company is insolvent if a liquidity gap that cannot be closed within three weeks accounts for at least ten percent of its total liabilities.Compare nur BGH, Urt. v. 24.5.2005 – IX ZR 123/04 = NZI 2005, 457; BGH, Urt. v. 17.11.2016 – IX ZR 65/15 = NZI 2017, 64

15This liquidity gap is determined by drawing up a liquidity balance sheet in which all liabilities falling due on the reporting date and in the three-week observation period following the reporting date are compared with the free cash and cash equivalents available in this period.

16The ten percent hurdle is the rule, but is not a rigid limit.Schmidt/Schröder, InsO, 9. Ed. (2022), Sec. 17 Sidenr. 29 bezugnehmend auf BGH, Urt. v. 24.5.2005 - IX ZR 123/04 = NZI 2005, 547 In exceptional cases, deviations can be justified. In the case of a liquidity gap of less than ten percent, insolvency may be assumed if it can be assumed that the ten percent will soon be exceeded. However, despite exceeding the ten percent hurdle, solvency can still be assumed if, due to special circumstances, it can be assumed that the liquidity gap will soon be closed completely or at least almost completely.BGH, Urt. v. 17.11.2016 – IX ZR 65/15 = NZI 2017, 64

17In practice, liquidity planning over a thirteen-week period (13-week liquidity planning) has become established as the usual procedure.Schulz, NZI 2020, 1073 (1074); gegen einen Prognosezeitraum von über drei Monaten Compare Uhlenbruck/Mock, InsO, 15. Ed. (2019), Sec. 17 Sidenr. 25 The choice of this period also appears to make sense here, as the inclusion of further weeks, on the one hand, reduces the likelihood of the management being liable to prosecution for insolvency violations and, on the other hand, creates better transparency for other stakeholders.

18According to Sec. 17 II 2 InsO, the insolvency of the company is presumed if the company has ceased its payments. This is the case if circumstances become apparent to legal transactions which indicate that the company can no longer meet its payment obligations. Such circumstances may be, for example, the late payment of social security contributions or tax claims, as well as arrears in wages, operating costs or insurance contributions.Compare nur BGH, Beschl. v. 15.11.2018 – IX ZR 81/18 = BeckRS 2018, 32036; Stürner/Eidenmüller/Schoppmeyer/Eilenberger, InsO, 4. Ed. (2019), Sec. 17 Sidenr. 29

(bb) Imminent insolvency, Sec. 18 InsO

19Pursuant to Sec. 18 I InsO, imminent insolvency also constitutes a ground for opening insolvency proceedings within the meaning of Sec. 16 InsO. In addition, imminent insolvency is a prerequisite for entry into the proceedings under the stabilization and restructuring framework of StaRUG. Companies should have the option of entering structured restructuring proceedings as early as possible in order to increase their chances of reorganization. The fact that there is only the option of filing an application on one's own prevents creditors from "pushing" the company into regular insolvency proceedings at an early stage before insolvency occurs.Compare BT-Dr. 12/2443, 114

20According to Sec. 18 II InsO, the company is threatened with insolvency if it is not expected to be able to meet its due payment obligations over a prog-nosis period of 24 months. In order to be able to make such a forecast of (in)solvency, all existing liabilities and those that are expected to arise and fall due during the forecast period must be compared with the cash and cash equivalents available at the respective expected due dates. If the comparison shows that the company will not be able to meet the liabilities then due at any time within the forecast period of 24 months, it must be regarded as being in imminent insolvency. In contrast to the determination of insolvency, it is not important here whether a liquidity gap is only temporary. The decisive factor is whether or not the company is likely to be able to meet all its liabilities as they fall due during the 24-month forecast period.Fridgen/Geiwitz/Göpfert/Wolfer, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 18 Sidenr. 22; Uhlenbruck/Mock, InsO, 15. Ed. (2019), Sec. 18 Sidenr. 20

21In the event of imminent insolvency, the managing director of the GmbH is not yet obliged to file an application. In addition, the obligations under Sec. 1 StaRUG take effect at the latest at this point, since the imminent insolvency represents an event that endangers the existence of the company.

22In the case of joint power of representation, the application to open insolvency proceedings in the event of imminent insolvency can only be filed jointly by all managing directors appointed to represent the company, Sec. 18 III InsO. In addition, the GmbH managing director should obtain a resolution from the shareholders' meeting in order not to be exposed to possible claims for damages, whereby the managing director is obliged to inform the shareholders anyway under Sec. 1 StaRUG (cf. the situation regarding the notification of a restructuring matter under the StaRUG).

(cc) Overindebtedness , Sec. 19 InsO

23According to Sec. 19 II 1 InsO, over-indebtedness exists if the assets no longer cover the existing liabilities (irrespective of the due date), unless the continuation of the company in the next twelve months is considered predominantly probable. In contrast to imminent insolvency, the forecast period is shortened from 24 months to 12 months. According to the most recent decision by the German parliament, the forecast period is temporarily reduced to four months in order to avoid the obligation to file for insolvency for companies whose continued existence would be out of the question if the current uncertainties were disregarded.BT-Dr. 20/4087; Amendment by the Federal Government with regard to BR-Dr. 20/2730 S. 5 In practice, this means that a company that does not become insolvent within the next four months is not overindebted. The reduction is not linked to any further preconditions. The provision also applies to companies that were already over-indebted before the relevant amendment to the Act came into force, but the relevant point in time for filing a timely application within the meaning of Sec. 15a I 1 has not yet passed.See Footnote 21

In order to determine the over-indebtedness status, a going concern forecast for the next twelve months must therefore be prepared in addition to the examination of the balance sheet over-indebtedness.

24The test of balance sheet over-indebtedness is a purely hypothetical one. For this purpose, all existing liabilities are compared with the company's assets, irrespective of when they are due. On the liabilities side of this over-indebtedness balance sheet, all monetary insolvency claims within the meaning of Sec. 38 InsO must be taken into account. Subordinated claims as defined in Sec. 39 InsO must also be recognized as liabilitiesUhlenbruck/Mock, InsO, 15. Ed. (2019), Sec. 19 Sidenr. 161; K. Schmidt/Schmidt, InsO, 19. Ed. (2016), Sec. 19 Sidenr. 35 , unless there is a qualified subordination as defined in Sec. 19 II 2 InsO. Assets are recognized at liquidation values, i.e. adjusted for hidden reserves and taking into account expected expenses for the sale, as well as expected losses in value depending on the speed of liquidation.Fridgen/Geiwitz/Göpfert/Wolfer, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 19 Sidenr. 21 f. Caution is generally required when determining the liquidation values in order to prevent the risk of liability due to breach of the obligation to file for insolvency.Compare dazu Uhlenbruck/Mock InsO, 15. Ed. (2019), Sec. 19 Sidenr. 130 ff.

25Only if the liabilities side of this balance sheet exceeds the assets side (see below) can over-indebtedness be considered as a reason for opening insolvency proceedings within the meaning of Sec. 19 InsO. However, this can only be affirmed with the legal consequence of the obligation to file an application if, in addition, the forecast of the company's ability to continue as a going concern, which is to be prepared in the second step, is negative. In the case of a positive going concern prognosis, however, there is no over-indebtedness within the meaning of Sec. 19 InsO.

Figure 2:

Comparison of non-overleveraged/overleveraged balance sheet with presentation of loss carryforward on the assets side for illustrative purposes.

(Adapted from: https://www.rwi.uzh.ch/static/elt/lst-vogt/gesellschaftsrecht/charakter/de/html/kapverlustuebersch_ueberschuldung.html)

26A favorable going concern assumption requires the will to continue as a going concern and the ability of the company to survive. The assessment of the ability to survive is made on the basis of a meaningful financial plan.BGH, Beschl. v. 9.10.2006 – II ZR 303/05 = NZI 2007, 44 The purpose of preparing a going concern forecast is to ensure that creditors are satisfied.Uhlenbruck/Mock, InsO, 15. Ed. (2019), Sec. 19 Sidenr. 220 The forecast must therefore be negative if the financial plan shows that it is highly unlikely that the company will be able to meet its liabilities as they fall due during the forecast period (cf. impending insolvency).Braun/Salm-Hoogstraeten, InsO, 9. Ed. (2022), Sec. 19 Rn 17

(c) Legal aspects of the crisis

(aa) Crisis prevention

27The regulations on capital resources and capital maintenance for the GmbH already ensure basic risk provisioning.Compare Schmidt/Uhlenbruck/Schmidt, GmbH in Krise, Sanierung und Insolvenz, 5. Ed. (2016), Sidenr. 1.31 ff. These include the obligation to make contributions, the liability for differences in the event of overvaluation of contributions in kind or the default liability under Sec. 24 GmbHG. This also includes Sec. 30, 31 GmbHG (prohibition of payment and duty of reimbursement), which serve to maintain the capital stock, and the duty to keep accounts pursuant to Sec. 41 GmbHG.

28The obligation to convene a shareholders' meeting in the event of a loss amounting to half of the share capital, as codified in Sec. 49 III GmbHG, is also one of the mechanisms of crisis prevention.

(bb) Early crisis detection through risk controlling

29According to Sec. 1 I StaRUG, the managing director of the GmbH is obliged to permanently take measures for early crisis detection. The early recognition of risk factors provides the company with a larger time frame within which it can act to avert the crisis and thus increases the chances of a successful and sustainable crisis response.Morgen/Gerig, StaRUG, 2. Ed. (2022), Sec. 1 Sidenr. 1 The monitoring obligation contained in Sec. 1 I StaRUG applies to the managers of all legal entities. Sec. 1 I StaRUG does not contain any specific requirements for the design of a crisis early warning system. The content and scope of the monitoring system are determined by the size and complexity of the company.BT-Dr 19/24181, 104 Depending on their business purpose, companies are also exposed to different risk factors. Risk controlling must keep this in mind.Compare Scholz/Schneider, GmbHG, 10. Ed. (2006), Sec. 43 Sidenr. 96 Irrespective of the size of the company, the managing directors are required to continuously monitor and review the conditions of the GmbH and developments relevant to the company's operations to determine whether they have the potential to jeopardize the company's continued existence if they continue unhindered.BT-Dr 19/24181, 104 The minimum requirement, irrespective of the size of the company, is proper accounting in accordance with general requirementsCompare Sec. 41 GmbHG and integrated income and liquidity planning for the period of 24 months.Gottwald/Haas/Haas/Kolmann/Kurz, Insolvenzrechts-Handbuch, 6. Ed. (2020), Sec. 90 Sidenr. 12

(cc) Crisis management

(aaa) Duty of the managing directors to restructure, Sec. 1 I 2 StaRUG

30In times of crisis, the managing director's duty to manage the company changes, at least partially, into a duty to restructure pursuant to Sec. 1 I 2 StaRUG.Müller/Winkeljohann/Axhausen, Beck’sches Handbuch der GmbH, 4. Ed. (2009), Sec. 15 Sidenr. 121

31The duty to take countermeasures under Sec. 1 I 2 StaRUG applies to the managing director from the onset of the first symptoms of a crisis. At the same time, Sec. 1 I 2 and 3 StaRUG require the managing director to immediately report to the supervisory bodies on the measures taken and, if they are responsible, to work towards their referral. Further obligations remain unaffected under Sec. 1 III StaRUG. The various obligations under company law and insolvency law that affect the managing director in the further course of the crisis () therefore continue to apply.

32The managing director must examine the company's ability to restructure and, if necessary, draw up a suitable restructuring concept. This includes the examination and subsequent implementation and monitoring of financial and performance-related restructuring options (for more details on out-of-court restructuring, see B below).

(bbb) Convening of the shareholders' meeting , Sec. 49 III GmbHG

33If the equity capital is depleted to half of the nominal capital figure, the managing director must immediately convene the shareholders' meeting in accordance with Sec. 49 III GmbHG. It should be noted, however, that this also applies in cases where the managing director becomes aware of such a loss without preparing an interim balance sheet.Sog. „Bilanz im Kopf des Geschäftsführers“; Compare Baumbach/Hueck/Zöllner, GmbHG, 20. Ed. (2013), Sec. 49 Sidenr. 20; Beck/Depré, Praxis der Insolvenz, 3. Auflage (2017), Sec. 33 Sidenr. 10

(ccc) Tension between out-of-court restructuring and filing for insolvency in the event of imminent insolvency

34If the company is already at the stage of imminent insolvency, the managing director is caught between the interests of the shareholders and those of the creditors. The filing of a petition for insolvency, which is possible but not obligatory after the onset of imminent insolvency, and the subsequent opening of insolvency proceedings have various disadvantages for the shareholders. First of all, claims for repayment of a shareholder loan or claims arising from legal acts which economically correspond to such a loan are only satisfied on a subordinate basis pursuant to Sec. 39 I No. 5 InsO. With the opening of insolvency proceedings, the shareholders also suffer a loss of control through the transfer of the power of disposal to the insolvency administrator, Sec. 80 I InsO. In contrast to the managing director, they are not authorized to issue instructions to the insolvency administrator. Furthermore, in the final distribution, the shareholders only receive the surplus which results after the complete satisfaction of all creditors, Sec. 199 InsO. Such a surplus rarely occurs, so that as a rule the shareholders can no longer expect any income from their participation when insolvency proceedings are opened.

35If the managing director files for insolvency when insolvency is imminent, he may be ignoring the interests of the shareholders. For this reason, it was previously mandatory for the managing director to obtain a shareholders' resolution in the event of impending insolvency if he wished to file an application. The absence of a resolution had no effect on the validity of the application, but could lead to liability in the internal relationship if the shareholders suffered financial damage.Geißler, ZInsO 2013, 919; Uhlenbruck/Mock, InsO, 15. Ed. (2019), Sec. 18 Sidenr. 76; Fridgen/Geiwitz/Göpfert/Fridgen/Geiwitz/Göpfert, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 18 Sidenr. 4. The managing director should therefore always obtain a consenting resolution of the shareholders prior to filing a self application in order to avoid liability.

36The same applies to the question of whether a consenting resolution of the shareholders must be obtained prior to notification of the restructuring matter under the StaRUG.Compare Braun/Ehret, StaRUG, 1. Ed. (2021), Sec. 1 Sidenr. 10; Morgen/Gerig, StaRUG, 2. Ed. (2022), Sec. 1 Sidenr. 21. Further details are given at the appropriate place.

(ddd) Obligation to file for insolvency pursuant to Sec. 15a InsO

37Pursuant to Sec. 15a I 1 InsO, the managing director of a GmbH is obliged to file an application if insolvency and/or overindebtedness has/have occurred. Representation relationships or internal management distributions are irrelevant, each member of the management is equally obliged to file an application and cannot be exempted from this by internal agreements.Uhlenbruck/Hirte, InsO, 15. Ed. (2019), Sec. 15a Sidenr. 7 Even a shareholders' resolution does not exempt the company from the obligation to file an application. Such an instruction is irrelevant, as it conflicts with the obligation to file an insolvency petition under criminal law.

38The application must be filed without culpable delay, but no later than three weeks after the occurrence of insolvency or six weeks after the occurrence of overindebtedness. In the wake of the current energy crisis, the German parliament decided to temporarily increase the maximum period for filing an insolvency petition in the event of over-indebtedness to eight weeks, although this period may still not be exhausted if a sustainable elimination of the over-indebtedness is deemed impossible at an earlier point in time.BT-Dr. 20/4087; Amendment by the Federal Government with regard to BR-Dr. 20/2730 S. 6

This is to take into account that the planning of remediation efforts in the current situation requires more time than usual, as the situation has become even more complex.See Footnote 38 The period begins with the occurrence of insolvency or overindebtedness. Knowledge or grossly negligent ignorance on the part of the managing directors is not required for the period to commence. The occurrence of the obligation to file an application is thus not linked to any reproachable conduct on the part of the managing directors.Stürner/Eidenmüller/Schoppmeyer/Klöhn, InsO, 4. Ed. (2019), Sec. 15a Sidenr. 118; Uhlenbruck/Hirte, InsO, 15. Ed. (2019), Sec. 15a Sidenr. 14

39The time limit is not suspended by reorganization efforts, regardless of whether these are promising or not.BGH, Urt. v. 12.2.2007 – II ZR 308/05 = NJW-RR 2007, 690

40Accordingly, the managing directors have a maximum of three weeks (six weeks in the case of over-indebtedness) from the date on which the insolvency proceedings become ripe to avoid the insolvency proceedings by taking out-of-court restructuring measures while avoiding the consequences under criminal and liability law. In the event of a breach of the obligation to file an application, there is a risk of claims for damages and consequences under criminal law (see below for more details).

(eee) Liability

41In the event of a breach of the obligation to file for insolvency, there is a risk not only of criminal consequences but also, in particular, of claims for damages by creditors and the company itself.

42If the managing director violates the obligation to file an application resulting from Sec. 15a I 1 InsO, he is obliged to compensate the creditors for the resulting damages. Negligent ignorance of the obligation to file an application is sufficient to justify the obligation to pay damages.

43If the managing director does not have the personal knowledge required to check whether the company is ready for insolvency, he is obliged to seek advice immediately from a professionally qualified person if there are signs of a crisis. If, on the basis of such advice, he refrains from filing an application despite the fact that the company is actually ready for insolvency and is therefore obliged to file an application, he may not be at fault.BGH, Urt. v. 27.3.2012 – II ZR 171/10 = NZG 2012, 672

44Pursuant to Sec. 15b InsO, the managing director is obliged to reimburse payments made after the occurrence of insolvency maturity.

45The payment ban applies as soon as the obligation to file an application arises, i.e. upon the occurrence of insolvency or overindebtedness, and not only upon expiry of the three- or six-week application period. The reimbursement obligation associated with the payment ban arises irrespective of fault for each prohibited payment, so there is a high liability risk for the managing director. The managing director must therefore (also independently of the obligation under Sec. 1 StaRUG) continuously monitor the financial situation of the company in order to protect himself from liability for prohibited payments.

46Pursuant to Sec. 15b I 2 InsO, there is no duty to reimburse for payments that are consistent with the diligence of a prudent business manager. In particular, payments that serve to maintain business operations are not prohibited, provided they are made before the expiry of the three- or six-week period. Payments for services are thus not fundamentally excluded from the scope of protection of the privilege rule.BT-Dr. 19/24181, 194

47However, even such payments which are to be regarded as necessary for the maintenance of the business operations can only benefit from this privilege if, at the same time, measures are pursued with the diligence of a prudent business manager for the sustainable elimination of insolvency maturity or for the preparation of an insolvency petition. Since the liability under Sec. 15b InsO and thus the question of whether a payment is subject to the privilege under Sec. 15b I 2 InsO practically only play a role in insolvency proceedings and thus in the event of the failure of any reorganization measures, the question will arise in particular as to the extent to which these failed measures can be measures for the sustainable elimination of the maturity for insolvency which keep open the scope of protection of the liability privilege. In order to prevent any backsliding in the subsequent assessment of reorganization measures, the managing director should therefore seek qualified advice and carefully document his decision-making process.Compare dazu auch Fridgen/Geiwitz/Göpfert/Wolfer, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 15b Sidenr. 20; Nerlich/Römermann/Mönning, InsO, 43. EL (2021), Sec. 15b Sidenr. 17

48Payments made with the consent of a provisional insolvency administrator between the filing of the petition and the opening of insolvency proceedings shall also be exempt from the payment ban.

(dd) Criminal law aspects of the crisis

49In addition to the civil law obligations and liability risks, the managing director of the GmbH also faces criminal law consequences in times of crisis, for example from Sec. 15a IV InsO, Sec. 263 StGB or Sec. 283 I No. 7b, VI StGB.Dazu vertieft Knops/Bamberger/Lieser/Lieser/Hancke, Recht der Sanierungsfinanzierung, 2. Ed. (2019), Sec 31 mwN.

(2) Restructuring outside a structured procedure

50As long as the GmbH is not insolvent or over-indebted, it can also be reorganized outside of judicial proceedings. In the event of insolvency or over-indebtedness, Sec. 19 InsO, the managing director is obliged to file an application under Sec. 15a I 1 InsO. Even promising reorganization efforts do not lead to an extension of the deadline.Schmidt/Uhlenbruck/Uhlenbruck, GmbH in Krise, Sanierung und Insolvenz, 5. Ed. (2016), Sidenr. 2.5 The managing director must therefore first check whether an out-of-court restructuring is still possible at all.

(a) General / Restructuring concept

51In order to prevent a temporary slide into material insolvency during the free reorganization, short-term measures should first be taken to temporarily secure liquidity. Possible measures include standstill agreements with banks or bridging loans from banks or shareholders.Compare Buth/Hermanns/Kraus, Restrukturierung, Sanierung, Insolvenz, 4. Ed. (2014), Sec. 4 Sidenr. 29 The disposal of non-operating assets can also help to improve liquidity in the short term.Buth/Hermanns/Kraus, Restrukturierung, Sanierung, Insolvenz, 4. Ed. (2014), Sec. 4 Sidenr. 31

52A restructuring concept must be developed from the results of a company analysis. The restructuring plan must be based on the known and recognizable facts and must clearly name and explain the measures with which sustainable restructuring is to be achieved.Thierhoff/Müller/Krumbholz, Unternehmenssanierung, 3. Ed. (2022), Chapt. 5 Sidenr. 44 Sustainable turnaround requires restructuring measures in strategic, operational and financial terms.Buth/Hermanns/Kraus, Restrukturierung, Sanierung, Insolvenz, 4. Ed. (2014), Sec. 4 Sidenr. 12

53On the basis of the restructuring concept, the company's ability to be restructured must be examined. The company is capable of being restructured if there is a sufficient probability that it will be able to generate profits again under its own steam.Müller/Winkeljohann/Axhausen, Beck’sches Handbuch der GmbH, 4. Ed. (2009), Sec. 15 Sidenr. 53 The restructuring concept serves as a decision-making basis for the creditors. If debt capital measures are required for financial restructuring - as is usually the case - the managing director must take all major creditors into account as part of an out-of-court restructuring settlement.

(b) Restructuring measures

(aa) Financial restructuring measures

54In the case of financial restructuring, a distinction must be made between internal and external financing measures.Buth/Hermanns/Kraus, Restrukturierung, Sanierung, Insolvenz, 4. Ed. (2014), Sec. 4 Sidenr. 30; Schmidt/Uhlenbruck/Uhlenbruck, GmbH in Krise, Sanierung und Insolvenz, 5. Ed. (2016), Sidenr. 2.16 Before taking external financing measures, possible measures for internal financing should be exhausted, as these can be achieved using the company's own resources and are therefore generally less bureaucratic and do not give rise to any new liabilities. Examples of internal financing measures include the reduction of working capital, the reduction of inventories and the disposal of non-operating assets.Compare Buth/Hermanns/Kraus, Restrukturierung, Sanierung, Insolvenz, 4. Ed. (2014), Sec. 4 Sidenr. 31

55In addition, it should be examined whether receivables management can be intensified.Buth/Hermanns/Kraus, Restrukturierung, Sanierung, Insolvenz, 4. Ed. (2014), Sec. 4 Sidenr. 31 In this context, it is also possible to reduce receivables through factoring. Although a discount on the value of the receivable must be expected, depending on the recoverability of the receivable, the company may save itself time-consuming collection efforts and can generate liquid funds in the short term by selling the receivable.Compare Thierhoff/Müller/Krumbholz, Unternehmenssanierung, 3. Ed. (2022), Chapt. 5 Sidenr. 116 f

(bb) Company sale

56The sale of a company as an asset deal (so-called transferring restructuring) can also be considered as a restructuring instrument outside of insolvency proceedings. In an asset deal, unlike a share deal, it is not the shares in the company that are sold, but the assets or certain parts of the assets of the company are transferred individually to the buyer. One restriction on the freedom of structuring is that the assumption of contractual relationships by the buyer requires the consent of the respective contractual partners. In addition, it must be ensured that the legal entity is sufficiently equipped to be liquidated, as there is a risk of the asset deal being contested in the event of the legal entity becoming insolvent.

(cc) Liquidation

57If the company cannot be restructured, an alternative may be the liquidation of the company and the legal entity. In this case, all assets are sold and all contractual relationships are terminated.Sec. 60 ff. GmbHG With the cessation of business operations, revenues cease. Although the discontinuation is typically also accompanied by a reduction in operating costs for materials, electricity, etc., existing contracts (e.g. personnel, rent) must be terminated in accordance with the statutory provisions and continue to be fulfilled until their termination. Against this background, careful planning of the liquidation is required.

(3) StaRUG proceedings

(a) General

58As a result of StaRUG, which came into force on January 1, 2021, debtors have been given the opportunity for the first time to implement a restructuring concept outside of insolvency proceedings against the wishes of individual creditors. According to Sec. 29 I StaRUG, the basic prerequisite for access to the stabilization and restructuring framework of StaRUG is always the threat of insolvency. However, the existence of imminent insolvency within the meaning of Sec. 18 InsO is not a prerequisite for access to the restructuring framework.Braun/Blümle/Erbe, StaRUG, 2021, vor Sec. 94 ff. Sidenr. 1 f.; Buth/Hermanns/Andres, Restrukturierung, Sanierung, Insolvenz, 5. Ed. (2022), Sec. 25 Sidenr. 195; Sonnleitner/Witfeld/Neu, Insolvenz- und Sanierungssteuerrecht, 2. Ed. (2022), Chapt. 9 Sidenr. 3; a.A. Cranshaw/Portisch, ZInsO 2020, 2561 (2576). It is disputed whether a secondary shareholder resolution is required for the notification of a restructuring project pursuant to Sec. 31 StaRUG. While the Hamburg District Court (AG Hamburg) recently affirmed this in a decisionDecision as of March 17, 2023 - 61c RES 1/23 = NZI 2023, 584. and in doing so referred to the comments of Rauhut, according to which the wording of Sec. 1 I Sentence 2 and 3 StaRUG as well as the reasoning of the law do not contain any indications that the managing directors should have the authority to give notice,NZI-Beilage 2021, 52 (54). this view can certainly be criticized. On the one hand, the notifi-cation does not have the effect of amending the Articles of Association and is still not likely to be regarded as an unusual transaction. First, the advertisement does not have the effect of amending the statute and is still unlikely to be considered an unusual transaction.Cf. Mock's comment on AG Hamburg, decision as of March 17, 2023 - 61c RES 1/23 = NZI 2023, 584 (585 ff.). The contrary view also fails to take into account the significance of Section 1 I Sentence 2 StaRUG, as this requires the management to take appropriate countermeasures against developments that could jeopardize the existence of the company. Against the background of the basically unlim-ited power of representation of the managing directors pursuant to Section 35 I Sentence 1 GmbHG, it therefore appears preferable not to require an affirmative shareholder resolution for the restructuring notification pursuant to Section 31 StaRUG. From a practical point of view, however, managing directors should obtain such a resolution for their own protection, especially since no unanimous opinion has yet been formed in case law on this issue.

(b) Restructuring plan and judicial restructuring framework

59Restructuring within the meaning of chapters 1 and 2 StaRUG shall be carried out by means of a restructuring plan drawn up by the company.S. zur konkreten Ausgestaltung die Checkliste das BMJ gem. Sec. 16 StaRUG: https://www.bmj.de/DE/Themen/FinanzenUndAnlegerschutz/Fruehwarnsysteme/checkliste.pdf;jsessionid=6C6A0A60CB7C1850218740C69C5213E1.2_cid289?__blob=publicationFile&v=3 In this context, the company can make use of various judicial instruments in a modular manner to support its restructuring efforts, or it can completely forego the involvement of the restructuring court. According to Sec. 29 II StaRUG, the instruments of the judicial stabilization and restructuring framework are judicial coordination of the plan, preliminary examination of the plan (also in the case of out-of-court coordination), stabilization (enforcement bar and liquidation bar) and confirmation of the plan. It should be noted, however, that enforcement of the plan against the will of individual creditors can only be considered in the event of judicial confirmation of the plan. The plan is adopted if at least 75% of the voting rights of each group are attributable to the adoption of the plan, Sec. 25 I StaRUG. A majority of 75% of the voting rights is not required.Braun/Herzig, StaRUG, 1. Ed. (2021) Sec. 25 Sidenr. 3; Morgen/Kowalewski/Praß, StaRUG, 2. Ed. (2022), Sec. 25 Sidenr. 33

60For the purpose of monitoring the restructuring process, the court shall appoint a restructuring officer in cases under Sec. 73 I, II StaRUG. The appointment shall be made ex officio if the rights of consumers or medium-sized, small or micro enterprises (SME = less than 250 employees and annual sales not exceeding 50 million or annual total assets not exceeding 43 million)Empfehlung der Kommission vom 6. Mai 2003 betreffend die Definition der Kleinstunternehmen sowie der kleinen und mittleren Unternehmen, AB. (EU) L 124 v. 20.04.2003, S. 36 are affected, if the company applies for a stabilization order which, with the exception of claims exempted under Sec. 4 StaRUG, is to be directed essentially against all creditors or if the restructuring plan expressly provides for monitoring of the corresponding performance to the creditors. In individual cases, the order may be dispensed with if it is not necessary or is disproportionate.

61The appointment shall also be made in accordance with paragraph 2 in cases where it is to be expected that the plan can only be implemented against the will of individual parties affected by the plan.

(c) Restructuring moderation, Sec. 94 to 100 StaRUG

62Even before the occurrence of imminent insolvency, the Company may file an application for the appointment of an independent reorganization facilitator.Braun/Blümle/Erbe, StaRUG, 2021, vor Sec. 94 ff. Sidenr. 1 f.; Buth/Hermanns/Andres, Restrukturierung, Sanierung, Insolvenz, 5. Ed. (2022), Sec. 25 Sidenr. 195; Sonnleitner/Witfeld/Neu, Insolvenz- und Sanierungssteuerrecht, 2. Ed. (2022), Chapt. 9 Sidenr. 3; a.A. Cranshaw/Portisch, ZInsO 2020, 2561 (2576).

63The restructuring facilitator, who is experienced in restructuring, acts as a neutral mediator in the out-of-court restructuring settlement negotiations. The purpose of his appointment is that, as an experienced moderator and independent authority, he moderates the mutual interests of the parties involved so that all are prepared to conclude an out-of-court settlement.Morgen/Ziegenhagen, StaRUG, 2. Ed. (2022), Sec. 94 Sidenr. 2 The Company can also have the negotiated settlement confirmed by the court. Pursuant to Sec. 97 III, 90 StaRUG, this means that the measures resolved in the settlement can only be challenged to a limited extent in subsequent insolvency proceedings.

(d) Practical example: Restructuring of a holding company

64The StaRUG offers advantages above all when the focus is on financial restructuring. In parallel with financial restructuring under the StaRUG, performance restructuring can also be carried out. However, this then follows general rules. In the example, a holding company with 4 subsidiaries was restructured (see chart below).

Figure 3: Representation of the holding structure with example values to illustrate the

need for restructuring

65The cause of the crisis at the holding company level was that one investment got into serious difficulties - to the point of insolvency. The losses incurred could not be absorbed by the other investments and, via the holding company, threatened to jeopardize them as well. As the holding company was liable for significant parts of the liabilities of the insolvent unit, there was a need for financial restructuring at the level of the holding company to prevent the other investments from being "infected". It was not necessary to restructure contractual relationships in terms of performance or to take any personnel measures in the other units.

66With the help of a management consultant, the holding company drew up a financial plan consisting of earnings and liquidity planning, as well as a draft restructuring plan, and then filed the restructuring case with the restructuring court.

67Since small creditors (consumers or SMEs) were also affected, a restructuring officer was appointed by the court pursuant to Sec. 73 StaRUG. During the negotiations on the restructuring plan, the main problem was the applicability of the rules on the tax treatment of the restructuring profit. The waiver by the creditors in the restructuring plan resulted in a book profit, which is in principle taxable and whose tax treatment first had to be clarified. After lengthy discussions with the responsible tax authorities, it was clarified that the requirements under Sec. 3a EStG, 7b GewStG, 7 I, 8 I, II KStG were met, even if a performance-based restructuring in the StaRUG did not take place. This was based primarily on considerations of European law.

68After the plan was accepted by the affected parties, the plan was confirmed by the court pursuant to Sec. 63 IV StaRUG. The plan quota was paid out.

(4) Debtor-in-possession-management, Sec. 270 ff. InsO

(a) General, Aim of debtor-in-possession-management

69The prerequisite for access to debtor-in-possession-management proceedings is the existence of a reason for insolvency (for more information on the reasons for insolvency).

70The objective of the proceedings is basically the self-organization of the legal entity.Braun/Riggert, InsO, 9. Ed. (2022), Sec. 270 Sidenr. 1 Even if this is the primary objective, all other ways of improving the position of creditors remain permissible, since the restructuring of the legal entity must not be at the expense of the creditors.BT-Dr. 19/24181, 204; Fridgen/Geiwitz/Göpfert/Ellers, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 270 Sidenr. 4 Thus, if the creditors would be worse off with a reorganization of the legal entity than without, the implementation of such a reorganization is ruled out.

71If the company is already insolvent or over-indebted, it has no other option than to enter into insolvency proceedings (with regard to liability and criminal law aspects). However, in deviation from the principle of Sec. 80 I InsO, which regulates the transfer of the right of administration and disposal to the insolvency administrator (more closely related to third-party administration), the company retains the possibility of disposing of the assets itself. This, in turn, is the central advantage of debtor-in-possession-management compared to regular insolvency proceedings.Thierhoff/Müller/Oberle, Unternehmenssanierung, 3. Ed. (2022), Chapt. 10 Sidenr. 97 By retaining the power of disposal, the loss of reputation typically associated with an insolvency petition can be mitigated, as the company itself can maintain and shape business relationships with suppliers and customers instead of having to hand over this task to an insolvency administrator. The order for debtor-in-possession-management is subject to strict conditions, the fulfillment of which means that the company must first demonstrate that it is "worthy” of debtor-in-possession-management at all.Compare Braun/Riggert, InsO, 9. Ed. (2022), Sec. 270 Sidenr. 2

72The application for debtor-in-possession-management can be filed by the company itself or by a creditor. In the case of a GmbH, the managing directors are entitled to file an application in accordance with Sec. 15 I 1 InsO (and are even obliged to do so in accordance with Sec. 15a InsO). If the GmbH is without a managing director, the body which has the authority to appoint a managing director and thus bears the responsibility for eliminating the lack of management is entitled and obliged to do so.

73Authorized signatories are per se not entitled to file an application.Uhlenbruck/Wegener, InsO, 15. Ed. (2019), Sec. 13 Sidenr. 73 The application cannot be made subject to a condition or limited in time.Braun/Sorg, InsO, 9. Ed. (2022), Sec. 13 Sidenr. 9; Stürner/Eidenmüller/Schoppmeyer/Vuia, InsO, 4. Ed. (2019), Sec. 13 Sidenr. 72

74The application must be addressed to the competent insolvency court. Pursuant to Sec. 2 InsO, subject-matter jurisdiction lies with the local courts in whose district a regional court has its seat. However, the federal states may make different arrangements from this.

(b) Preliminary debtor-in-possession-management

75If the requirements are met, the court orders provisional debtor-in-possession-management for the period until proceedings are opened. In this way, the company avoids the appointment of a preliminary insolvency administrator and can thus retain the greatest possible control over the proceedings from the outset.

76The appointment of a provisional insolvency monitor takes place with the order of provisional debtor-in-possession-management, Sec. 270b I InsO. The insolvency monitor must be independent of the debtor and the creditors in accordance with Sec. 56 I InsO. In practice, the provisional insolvency monitor is often also appointed as insolvency monitor in the opened proceedings.

77The insolvency court terminates self-administration ex officio if the company seriously breaches its obligations under insolvency law, fails to remedy remediable deficiencies in the debtor-in-possession-management plan within the rectification period or if the achievement of the self-administration objective set proves to be futile. In order to prevent a revocation due to failure to achieve the objective of the proceedings, the debtor company should devote the greatest care to the presentation of the objective of the proceedings.Thierhoff/Müller/Oberle, Unternehmenssanierung, 3. Ed. (2022), Chapt. 10 Sidenr. 14 After the cancellation, the procedure is continued as a third-party administrative procedure.Thierhoff/Müller/Oberle, Unternehmenssanierung, 3. Ed. (2022), Chapt. 10 Sidenr. 113; Stürner/Eidenmüller/Schoppmeyer/Kern, InsO, 4. Ed. (2019), Sec. 272 Sidenr. 68

(c) Debtor-in-possession-management in opened proceedings

(aa) Requirements for the order of debtor-in-possession-management

78In the event of a prior order of provisional debtor-in-possession-management, the court shall examine at that point whether the prerequisites for this continue to exist. Pursuant to Sec. 270f I InsO, the ordering of debtor-in-possession-management also depends on whether there are facts on the basis of which the provisional debtor-in-possession-management would have to be revoked pursuant to Sec. 270e InsO..

(bb) Legal status of the insolvency monitor

79The insolvency monitor is obliged to supervise the company in the exercise of its administrative and disposal powers pursuant to Sec. 275 et seq. InsO, Sec. 274 II InsO, to supervise the company in the exercise of its administrative and disposal powers.

80If ordered, the insolvency monitor shall assist the company pursuant to Sec. 274 II 2 InsO in the pre-financing of insolvency benefits, accounting under insolvency law and negotiations with customers and suppliers. Pursuant to Sec. 274 III InsO, the insolvency monitor shall inform the insolvency court and the creditors' committee of any circumstances which indicate that the continuation of debtor-in-possession-management will lead to disadvantages for the creditors.

81Pursuant to Sec. 275 I InsO, the company shall enter into liabilities only with the consent of the insolvency monitor or in agreement with the insolvency monitor.

82The company may not enter into liabilities that are part of the debtor's ordinary business operations if the insolvency monitor objects beforehand. Although the company is not required to obtain consentStürner/Eidenmüller/Schoppmeyer/Kern, InsO, 4. Ed. (2019), Sec. 275 Sidenr. 9; a.A. Uhlenbruck/Zipperer, InsO, 15. Ed. (2019), Sec. 275 Sidenr. 4 , it must nevertheless inform the insolvency monitor so that the latter has the opportunity to exercise his right of objection appropriately.Stürner/Eidenmüller/Schoppmeyer/Kern, InsO, 4. Ed. (2019), Sec. 275 Sidenr. 13; Uhlenbruck/Zipperer, InsO, 15. Ed. (2019), Sec. 275 Sidenr. 4 Prior agreement on the scope of the duty to provide information is imperative, as this is the only way to prevent a constant need for new coordination between the company and the insolvency monitor, which would disrupt ongoing business operations.Stürner/Eidenmüller/Schoppmeyer/Kern, InsO, 4. Ed. (2019), Sec. 275 Sidenr. 13; Fridgen/Geiwitz/Göpfert/Plaßmaier/Ellers, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 275 Sidenr. 11

83Liabilities outside the ordinary course of business, on the other hand, shall only be entered into with the prior consent of the insolvency monitor.Uhlenbruck/Zipperer, InsO, 15. Ed. (2019), Sec. 275 Sidenr. 4; Fridgen/Geiwitz/Göpfert/Plaßmeier/Ellers, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 275 Sidenr. 8; Stürner/Eidenmüller/Schoppmeyer/Kern, InsO, 4. Ed. (2019), Sec. 275 Sidenr. 15

(cc) Repeal

84The termination of debtor-in-possession-management is subject to the requirements of Sec. 272 InsO. It shall take place ex officio in the event of a serious breach of duty or hopelessness (in this respect, the statements made above in respect of Sec. 270e InsO shall apply mutatis mutandis). Cancellation shall also take place upon application pursuant to Sec. 272 I Nos. 3 to 5 InsO..

(5) Protective Shield Proceedings

(a) Norm Purpose

85The protective shield proceedings pursuant to Sec. 270d InsO are a special variant of provisional debtor-in-possession-management.Thierhoff/Müller/Oberle, Unternehmenssanierung, 3. Ed. (2022), Chapt. 10 Sidenr. 116; Fridgen/Geiwitz/Göpfert/Ellers, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 270d Sidenr. 1 The aim of this constellation of proceedings is to enable the company to draw up a restructuring plan under the supervision of a provisional insolvency monitor within a period determined by the court, without having to fear enforcement by its creditors in the meantime. As in the case of provisional debtor-in-possession-management, the company is not subject to the restrictions on its right of administration and disposal following the appointment of a provisional insolvency administrator, but can exercise this right itself within the limits described above ().BT-Dr. 17/5712, 40

86The protective shield proceedings offer advantages compared to provisional debtor-in-possession-management, but are also subject to stricter requirements.

87Provided that the company comprehensively fulfills the requirements, it has a bound claim to the order of the requested protective shield proceedings pursuant to Sec. 270d I 1 In-sO. The court then sets a maximum three-month deadline for the submission of an insolvency plan. Although this does not oblige the Company to submit an insolvency plan.Braun/Riggert, InsO, 9. Ed. (2022), Sec. 270d Sidenr. 13; Fridgen/Geiwitz/Göpfert/Ellers, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 270d Sidenr. 59

88In order to ensure the success of the reorganization, the Company may apply for protective measures under Sec. 270c III, 21 I, II 1 No. 1a, 3 to 5 InsO. The protective shield essentially consists in the fact that the company has a bound claim under Sec. 270d III InsO that the insolvency court, upon its application, prohibits compulsory execution against the company's movable assets during the set period.[Compare Fridgen/Geiwitz/Göpfert/Ellers, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 270d Sidenr. 4

89With regard to the provisional insolvency monitor, the comments on temporary debtor-in-possession-management apply accordingly.

90However, a significant advantage over debtor-in-possession-management continues to be the right of the company to propose the person of the insolvency monitor under Sec. 270d II 2 InsO.Compare Fridgen/Geiwitz/Göpfert/Ellers, BeckOK Insolvenzrecht, 26. Ed. (2022), Sec. 270d Sidenr. 7; Thierhoff/Müller/Oberle, Unternehmenssanierung, 3. Ed. (2022), Chapt. 10 Sidenr. 120 Pursuant to Sec. 270d II 3 InsO, the court is bound by this proposal to the greatest possible extent. It may only deviate from it if the proposed person is obviously unsuitable.

(b) Practical example: Restructuring of a sales company of a globally operating wine wholesale company

91A globally active wine wholesaler with its own vineyard and winery, whose roots go back to the 17th century, was struggling with economic problems for the first time in the mid-1990s. The main reasons for this were the intensification of competition in terms of direct sales to end customers, the aging of existing customers and growing pension claims. The resulting deficits for the company, which was part of a holding company, were initially offset by income from its own subsidiaries and capital measures taken by the parent company. However, the losses could not be sustained in the long term, so that the sales company decided to file an application for the opening of insolvency proceedings in self-administration within the framework of protective shield proceedings within the meaning of Sec. 270a, 270d InsO.

92In parallel, a new managing director with experience in sales was appointed and the proceedings were accompanied by a Chief Restructuring Officer (CRO) experienced in insolvency and restructuring proceedings. A provisional creditors' committee was formed. Initial restructuring measures were initiated and the sales organization was strengthened in order to achieve the goal of no longer generating operating losses as of the opening of the proceedings. To ensure this, personnel measures were taken in accordance with Sec. 123 et seq. InsO, as a result of which 50 employees were made redundant. In addition, the sales organization was realigned by terminating superfluous sales offices, streamlining the network of sales representatives and terminating long-term debt relationships. At the same time, negotiations were held with the Pension Protection Association (PSVaG). In return for an improvement in the plan the PSV took over the pension claims so that the Company was permanently relieved of this obligation.

93The implementation of a dual-track procedure was discussed with the creditors' committee. In the end, however, it was decided against this, as the administration was essentially carried out via the parent company, but not via the insolvent sales company, and, with the exception of the sales team, no assets were held by the sales company. In addition, all trademark rights were owned by the parent company. All of this spoke against the saleability of the unit.

94The shareholder had agreed to make an appropriate plan contribution to secure the quota.

(6) Regular procedure (third-party management)

(a) General

95Even if debtor-in-possession-management appears at first glance to be the more attractive procedure, the standard procedure is in no way inferior to it, with the exception of a few points. The standard procedure also allows the company to be restructured and does not necessarily lead to liquidation..

(b) Insolvency opening proceedings

(aa) Insolvency filing

96Pursuant to Sec. 13 I 1 InsO, the proceedings shall only be opened upon application, be it an own The managing director shall be obligated pursuant to Sec. 20 I 1, 101 I 1 InsO to provide the required information and to submit the relevant documents even beyond the application.Thierhoff/Müller/Roth, Unternehmenssanierung, 3. Ed. (2022), Chapt. 10 Sidenr. 53 In addition, according to Sec. 20 I 2, 97 I 2 InsO, he is also obliged to disclose facts which are suitable to establish criminal liability against him. According to Sec. 97 I 3 InsO, these may not be used against him in subsequent criminal proceedings without his consent. The managing director may be obliged to make an affirmation in lieu of oath, may be compulsorily summoned and, in extreme cases, may even be imprisoned in the event of serious violations of the duty to disclose and cooperate, Sec. 20 I 2, 98 InsO.

If the relevant requirements are met (in particular: grounds for insolvency and sufficient insolvency assets), the court shall open the insolvency proceedings by way of an order. If debtor-in-possession-management has not been applied for or if the requirements for it are not met, the court appoints an insolvency administrator, Sec. 27 I InsO. The court shall request the creditors to file their claims with the insolvency administrator within a certain period and to notify him of the security interests claimed in the debtor's property and rights, Sec. 28 InsO.

(bb) Provisional insolvency administration

97Depending on the case, a certain amount of time elapses between the filing of the application and the opening of proceedings. If business operations are ongoing, decisions must also be made during this phase. In order to ensure the protection of the future insolvency estate during the opening proceedings, provisional insolvency administration has become established in the standard proceedings.

98According to Sec. 22 III InsO, the preliminary insolvency administrator is entitled to enter the business premises of the company and to inspect the books and other business documents. In addition, a reservation of consent under Sec. 21 II 1 No. 2 Alt. 2 InsO or, more rarely, a general prohibition of disposal pursuant to Sec. 21 II 1 No. 2 Alt. 1 InsO is ordered.

(aaa) Preliminary insolvency administrator

99If a reservation of consent is ordered pursuant to Sec. 21 II 1 No. 2 Alt. 2 InsO is referred to as a common preliminary insolvency administrator, as his powers are significantly less extensive than in the case of an order for a general prohibition of disposal pursuant to Sec. 21 II 1 No. 2 Alt. 1 InsO. The company may only make dispositions with the consent of the preliminary insolvency administrator, whereby the reservation of consent can also be limited to certain dispositions.Uhlenbruck/Vallender, InsO, 15. Ed. (2019), Sec. 21 Sidenr. 24 By their very nature, commitment transactions are not covered by this. The Company may continue to enter into such transactions without the involvement of the preliminary insolvency administrator.BGH, Urt. v. 21.2.2013 – IX ZR 69/12 = NZI 2013, 434 Consent pursuant to Sec. 21 II 1 No. 2 Alt. 2 InsO means not only prior consent within the meaning of Sec. 183 1, 182 BGB but also subsequent approval within the meaning of Sec. 184 I, 182 BGB.Uhlenbruck/Vallender, InsO, 15. Ed. (2019), Sec. 21 Sidenr. 24; Stürner/Eidenmüller/Schoppmeyer/Haarmeyer/Schidt, InsO, 4. Ed. (2019), Sec. 21 Sidenr. 65 Dispositions made by the company without the prior consent of the provisional insolvency administrator are pendingly invalid under Sec. 185 II BGB until subsequent approval. This form of provisional insolvency administration has become established as the rule in practice, as it is less drastic than the imposition of a general prohibition on disposals.Compare Uhlenbruck/Vallender, InsO, 15. Ed. (2019), Sec. 21 Sidenr. 24

(bbb) Strong preliminary insolvency administrator

100If a general prohibition of disposal is imposed on the company pursuant to Sec. 21 II 1 No. 2 Alt. 1 InsO, one speaks of a so-called strong preliminary insolvency administrator, since the power of administration and disposal of the company's assets is transferred in full to the preliminary insolvency administrator pursuant to Sec. 22 I 1 InsO. In practice, this form of provisional administration is the exception.

(dd) Other provisional measures

101In order to prevent a further deterioration in the financial situation of the company during the opening proceedings, the court may take further provisional protective measures in accordance with Sec. 21 II 1 InsO to protect the creditors. These include the convening of a preliminary creditors' committee, the ordering of an execution freeze or a prohibition of realization and confiscation and the imposition of a postal freeze.

(ee) Insolvency allowance

102Wage arrears from the last three months prior to commencement of insolvency proceedings shall be settled by the Federal Employment Agency pursuant to Sec. 165 SGB III. The wage claims are ipso iure transferred to the Federal Employment Agency in accordance with Sec. 169 SGB III and can be filed as insolvency claims in accordance with Sec. 55 III 1 InsO. Insolvency benefits are not paid out until the insolvency proceedings have been opened. In order to prevent an exodus of important employees already during the opening proceedings, the insolvency money can be financed in advance if the prognosis for continuation is positive.Buth/Hermanns/Saegon, Restrukturierung, Sanierung, Insolvenz, 4. Ed. (2014), Sec. 24 Sidenr. 22 The bank providing the advance financing can be secured by advance assignment of the insolvency benefit claims arising when the proceedings are opened. Pursuant to Sec. 170 IV SGB III, advance financing requires the approval of the Federal Employment Agency and must therefore always be carried out in close coordination with the latter.

(c) The person of the insolvency administrator

103The insolvency administrator is entrusted with the administration and liquidation of the insolvency estate in accordance with Sec. 80 et seq. InsO, the insolvency administrator is entrusted with the administration and liquidation of the insolvency estate and is obliged to protect the interests of the creditors in accordance with Sec. 1 InsO. The appointment is made by the insolvency court. If the preliminary insolvency administration has been ordered, the person of the preliminary insolvency administrator is generally also appointed as the insolvency administrator. If a preliminary creditors' committee has been set up, it is given the opportunity to comment pursuant to Sec. 56a I InsO. According to Sec. 56a II 1 InsO, the court may only deviate from the unanimous proposals of the preliminary creditors' committee if the proposed person is not suitable. At the first creditors' meeting following the appointment of the administrator, the creditors may elect another person as insolvency administrator. The administrator receives a standard remuneration based on the value of the assets administered, Sec. 63 I 2 InsO.

(d) Effects of the opening of proceedings

(aa) General effects

104In the case of a GmbH, the opening of insolvency proceedings constitutes a reason for dissolution pursuant to Sec. 60 I No. 4 GmbHG, which is also entered in the Commercial Register. The registered dissolution does not yet lead to the deletion of the company.

105With the opening of insolvency proceedings, the right of administration and disposal of the insolvency estate passes to the insolvency administrator pursuant to Sec. 80 I InsO. Dispositions of the company after the opening of insolvency proceedings are ineffective according to Sec. 81 I 1 InsO.

106Court proceedings, insofar as they concern the insolvency estate, are interrupted by the opening of proceedings pursuant to Sec. 240 ZPO and may be commenced by the insolvency administrator or, in the cases of Sec. 86 InsO, by the opponent in accordance with Sec. 85, 86 InsO.

107Pursuant to Sec. 87 InsO, the insolvency creditors may only pursue their claims in accordance with the provisions of the Insolvency Code. The securities obtained by enforcement measures from the period from one month before the filing of the petition until the opening of the insolvency proceedings become retroactively ineffective upon the opening of the insolvency proceedings pursuant to Sec. 88 I InsO (so-called non-return bar). Satisfactions already obtained are not affected by this.Braun/Kroth, InsO, 9. Ed. (2022), Sec. 88 Sidenr. 5 Both civil law and administrative law enforcement measures fall under this setback barrier.Braun/Kroth, InsO, 9. Ed. (2022), Sec. 88 Sidenr. 1; Stürner/Eidenmüller/Schoppmeyer/Breuer/Flöther, InsO, 4. Ed. (2019), Sec. 88 Sidenr. 13 During the insolvency proceedings, all individual enforcement measures against the Company's assets are prohibited under Sec. 89 I InsO and are invalid if they are carried out in violation of this prohibition.

(bb) Existing legal transactions

108With regard to existing mutual contracts which have not yet been completely fulfilled by both parties at the opening of proceedings, the insolvency administrator may in principle choose whether to fulfill them or not, pursuant to Sec. 103 I InsO. If he decides in favor of performance, he must effect the performance owed from the assets of the insolvency estate and may in return draw the performance owed by the creditor from the assets of the insolvency estate. If he waives performance, no further exchange of performance takes place. For certain legal transactions, Sec. 104 et seq. InsO contain special provisions.Compare Buth/Hermanns/Saegon, Restrukturierung, Sanierung, Insolvenz, 4. Ed. (2014), Sec. 24 Sidenr. 63

(cc) Insolvency avoidance

109The instrument of avoidance in insolvency enables the insolvency administrator to reverse asset transfers that have led to a reduction of the future insolvency estate prior to the opening of proceedings and thus to a disadvantage of the creditors as a whole after the opening of insolvency proceedings.Compare BT-Dr. 12/2443, 156 By reversing the satisfaction of individual preferred creditors and drawing the displaced assets back to the insolvency estate, the goal of equal satisfaction of all creditors can be enforced by the insolvency administrator.

(dd) Administration and liquidation of the insolvency estate

110After the opening of insolvency proceedings, the insolvency administrator takes possession of and administers the assets pursuant to Sec. 148 I InsO. The further progress of the proceedings is largely determined by the creditors, since according to Sec. 157 S. 1 InsO they decide in the creditors' meeting whether the company's operations are to be shut down or continued. They can also instruct the insolvency administrator to draw up an insolvency plan in accordance with Sec. 157 S. 2 InsO. If no insolvency plan is drawn up or if the creditors are in favor of liquidation of the company, the assets belonging to the estate shall be liquidated by the insolvency administrator in accordance with Sec. 159 InsO.Compare Buth/Hermanns/Saegon, Restrukturierung, Sanierung, Insolvenz, 4. Ed. (2014), Sec. 24 Sidenr. 57

111The final distribution takes place in accordance with Sec. 196 I InsO after completion of the liquidation. The creditors are taken into account in accordance with their established claims. Subordinated creditors are only taken into account after complete satisfaction of the other creditors. Any remaining surplus is to be distributed to the shareholders pursuant to Sec. 199 S. 2 InsO.

(e) Costs of the insolvency proceedings

112Pursuant to Sec. 54 of the Insolvency Code, the costs of the insolvency proceedings shall consist of the court costs and the remuneration of the preliminary insolvency administrator, the insolvency administrator and the members of the creditors' committee.

(f) Insolvency plan

(aa) General

113Sec. 1 S. 2 Alt. 2 InsO offers the possibility of restructuring the legal entity by means of an insolvency plan as an alternative to liquidation of the assets. The aim is usually the continuation of the company. In addition to the reorganization of the company, the objectives of the plan proceedings may also include forms of liquidation and procedures that deviate from the standard procedure.Braun/Frank, InsO, 9. Ed. (2022), Sec. 217 Sidenr. 1; Uhlenbruck/Lüer/Streit, InsO, 15. Ed. (2019), Sec. 217 Sidenr. 1

(bb) Submission authorization

114According to Sec. 218 I 1 InsO, the insolvency administrator and the company itself are entitled to submit an insolvency plan.

(cc) Components of the insolvency plan

115Pursuant to Sec. 219 InsO, the insolvency plan consists of the representative part, the formative part and the annexes pursuant to Sec. 229 seq. InsO.

116The representative part describes the nature of the measures taken after the opening of proceedings and those which are still to be taken. It also contains information on the basis and effects of the plan, which are relevant for the consenting parties with regard to their decision on possible consent to the plan and its confirmation by the court. In addition, the effects of the plan on the creditors' prospects of satisfaction (composition account) must be explained.

117The formative part pursuant to Sec. 221 InsO is considered the "execution part", as it contains all the provisions on how the legal position of the parties is to be changed by the plan. This includes, first and foremost, the waiver of the part of the creditors' claims exceeding the quota.Braun/Frank, InsO, 9. Ed. (2022), Sec. 221 Sidenr. 15

(dd) Voting procedure

118The insolvency court shall first conduct a preliminary examination pursuant to Sec. 231 InsO.Nerlich/Römermann/Ober, InsO, 43. EL (2021), Sec. 231 Sidenr. 1; Schmidt/Thies, InsO,7. Ed. (2018), Sec. 231 Sidenr. 1 If there is no rejection within the meaning of Sec. 231 InsO, the insolvency court shall set a date in accordance with Sec. 235 I 1 InsO for a discussion of the insolvency plan and the voting rights of the parties involved, and a subsequent vote on the plan (discussion and voting date).

119The prohibition of obstruction pursuant to Sec. 245 InsO allows the plan to be implemented against the will of individual voting groups previously formed, provided that they would not be worse off as a result than in the normal proceedings.

(ee) Confirmation of the insolvency plan

120In order to protect the parties to the proceedings, Sec. 248 I InsO requires confirmation by the insolvency court of an insolvency plan accepted by the parties to the proceedings in order to ensure that only one plan becomes effective pursuant to Sec. 254 et seq. InsO (), which has come about in an orderly manner and whose content complies with the statutory requirements.Braun/Frank, InsO, 9. Ed. (2022), Sec. 248 Sidenr. 1

(ff) Legal effects of the insolvency plan

121With the legally binding confirmation decision by the insolvency court pursuant to Sec. 248 InsO, the provisions set forth in the constructive part pursuant to Sec. 254 I InsO become effective for and against all parties involved and, subject to Sec. 255 f. InsO, are final. InsO final.Fridgen/Geiwitz/Göpfert/Freund/Stadler, BeckOK Insolvenzrecht, 26. Ed. (2022),Sec. 254 Sidenr. 2

(gg) Tax treatment of reorganization profits in insolvency plan proceedings

122According to Sec. 3a II EStG, a company-related reorganization exists "if the taxpayer proves the need for reorganization and the ability to reorganize the company, the suitability for reorganization of the business-related debt forgiveness and the intention of the creditors to reorganize at the time of the debt forgiveness". According to Sec. 3a I 1 EStG, restructuring profits (or income) are increases in business assets as well as business income from the cancellation of debts for the purpose of restructuring. According to Sec. 3a I 1 EStG, these are tax-free in total.Roth, Insolvenzsteuerrecht, 3. Ed. (2021), Sidenr. 4.22

123Beneficiaries within the meaning of Sec. 3a I 1 Alt. 2 EStG, only business-related debt cancellations are eligible, i.e. both privately-related debt cancellations and the cancellation of liabilities due to confusion are not covered by this.Roth, Insolvenzsteuerrecht, 3. Ed. (2021), Sidenr. 4.22 However, this does include income generated from a debt-equity swap and, under certain conditions, book profits generated by subordination.Brandis/Heuermann/Krumm, EStG, 160. EL (2021), Sec. 3a Sidenr. 20; Eilers/Schwahn, Sanierungssteuerrecht, 2. Ed. (2020), Sidenr. 2.42 f. The same applies under Sec. 3a V EStG to increases in assets due to a discharge of residual debt.

124Sec. 3a EStG is also relevant for the tax treatment under trade tax pursuant to Sec. 7b GewStG. The same applies to corporate income tax under Sec. 7 I, 8 I-II KStG.Roth, Insolvenzsteuerrecht, 3. Ed. (2021), Chapt. 4 Sidenr. 309

(g) Practical example of an asset deal: Transferring the reorganization of a specialty mechanical engineering company

125An international engineering company had accumulated substantial operating losses. As a result of the crisis, internal problems of the company became apparent, namely incomplete recording of customer orders, incorrect calculations, no or inadequate post-calculations, poor internal communication and a lack of leadership competence at management level. Initially, there was a management crisis, the consequences of which escalated into a liquidity crisis. Despite out-of-court restructuring measures, insolvency proceedings had to be filed.

126Due to the long lead times, the insolvency money effect alone could not ensure liquidity in the proceedings, so that a genuine mass loan became necessary. With the approval of the provisional creditors' committee, such a loan was taken out with a local bank. This made it possible to pay suppliers, some of whom were also prepared to deliver against a cost commitment, and to complete the orders.